Stock Split: Definition, How They Work, Impact on Price

Fractional investing is when you own a portion of one singular share of a stock. You might buy up to a certain dollar amount or you can buy up to a certain amount in fractional shares. At the end of this process, the total number of shareholders would be reduced.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. For example, your 100 share position valued at $300 would convert into a 300-share position still valued at $300, but at $1 per share on 300 shares. In the U.K., a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Any disruptions in the distribution of products to its warehouse stores can negatively affect sales.

What is a stock split?

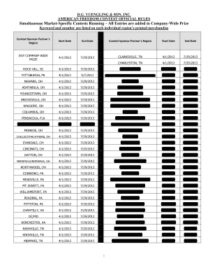

A company carrying out a reverse stock split decreases the number of its outstanding shares and increases the share price proportionately. As with a forward stock split, the market value of the company after a reverse stock split remains the same. Many of the best companies routinely see their share price return to levels at which they previously split the stock, leading to another stock split. Walmart, for instance, split its stock 11 times on a 2-for-1 basis between the retailer’s stock-market debut in October 1970 and March 1999. An investor who bought 100 shares in Walmart’s initial public offering (IPO) would have seen that stake grow to 204,800 shares over the next 30 years without any additional purchases.

- Simply put, if the first number is larger (as in «3-for-1»), it is a forward split.

- This issue could potentially be remedied by reverse splitting the shares and increasing how much each of their shares trades for.

- The most common type of stock split is a forward split, which means a company increases its share count by issuing new shares to existing investors.

- A reverse stock split occurs when a company consolidates the number of existing shares of stock into fewer higher-priced shares.

- Q.ai. Q.ai offers advanced investment strategies that combine human ingenuity with AI technology.

It’s important to know that a reverse stock split generally (but not always) happens for a negative reason such as after a big decline in a stock’s price. A stock split is a corporate action that involves the division of each of a company’s shares into multiple shares, tara wolkenhauer increasing the total stock in the company. This revalues the price per share to ensure the market capitalisation of the company does not change. In such cases, companies undergo this corporate action simply to maintain their listing on a premier stock exchange.

For example, in a 2-for-1 stock split, a shareholder receives two shares after the split for every share they owned before the split. However, split ratios can go various ways, including 20-for-1, 100-for-1, etc. A 1-for-10 split means that for every 10 shares you own, you get one share. Below, we illustrate exactly what effect a split has on the number of shares, share price, and the market cap of the company doing the split. There are many reasons why a company may consider a stock split. Since stock splits don’t add market value, much of it comes down to making the stock more attainable to everyday investors, and the behavioral benefits of that.

A stock split’s most significant impact is on new investors, eyeing up a particular stock and hoping to purchase a round lot of shares at a lower cost. Thus, a stock split can provide a powerful motivator to get in the action. Basically, most investors might be more willing to buy, say, 100 shares of a $10 stock instead of 1 share of a $1,000 stock.

The bottom line on investing in Costco

A stock split is normally an indication that a company is thriving and its stock price has increased. Though theoretically, it should not affect a stock’s price, it often results in renewed investor interest, which can positively influence the stock price. While this effect may wither over time, stock splits by blue-chip companies (established, stable, and well-organized corporations) are a bullish signal for investors. There are plenty of arguments over whether stock splits help or hurt investors. One side says a stock split is a good buying indicator, signaling the company’s share price is increasing and doing well.

A company may do this if they are afraid their shares are going to be delisted or as a way of gaining more respectability in the market. Many stock exchanges will delist stocks if they fall below a certain price per share. When a stock splits, it can also result in a share price increase—even though there may be a decrease immediately after the stock split. This is because small investors may perceive the stock as more affordable and buy the stock. This effectively boosts demand for the stock and drives up prices.

What is a Stock Split? Definition & Examples

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Enter your email address below to receive the latest headlines and analysts’ recommendations for your stocks with our free daily email newsletter.

- One of the most common is to increase liquidity, by making it easier for people to trade shares.

- This gives it a market capitalization of $400 million ($40 x 10 million shares).

- A stock split is a corporate action in which a company issues additional shares to shareholders, increasing the total by the specified ratio based on the shares they held previously.

- A reverse stock split is also known as a stock consolidation, stock merge, or share rollback and is the opposite of a stock split, where a share is divided (split) into multiple parts.

- This revalues the price per share to ensure the market capitalisation of the company does not change.

Though regular stock splits, also known as forward splits, are a positive indication of the success of a company, a reverse stock split can indicate that a company in trouble. In the end, a stock split—or even a reverse stock split—doesn’t have a huge practical impact on a company’s current investors. A stock split’s biggest impact is on investors who might be watching a particular stock and hoping to purchase a full share for a lower price. For those investors, a stock split can provide a powerful motivator to get off the sidelines.

Financial Calendars

While there are some psychological reasons why companies split their stock, it doesn’t change any of the business fundamentals. Remember, the split has no effect on the company’s worth as measured by its market cap. In the end, whether you have two $50 bills or single $100, you have the same amount in the bank. None of these reasons or potential effects agree with financial theory. A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory.

Owlet’s 1-for-14 Reverse Stock Split to Become Effective Friday – Marketscreener.com

Owlet’s 1-for-14 Reverse Stock Split to Become Effective Friday.

Posted: Fri, 07 Jul 2023 07:00:00 GMT [source]

There are several reasons companies consider carrying out a stock split. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable. Splitting the stock brings the share price down to a more attractive level.

Types of stock split

Your broker should automatically place the new shares into your account after the effective date of the split. The process of a stock split is expensive, requires legal oversight, and must be performed in accordance with regulatory laws. The company wanting to split their stock must pay a great deal to have no movement in its over market capitalization value.

A stock split lowers its stock price but doesn’t weaken its value to current shareholders. It increases the number of shares and might entice would-be buyers to make a purchase. When a stock splits, many charts show it similarly to a dividend payout and therefore do not show a dramatic dip in price. Taking the same example as above, a company with 100 shares of stock priced at $50 per share. There are now 200 shares of stock and each shareholder holds twice as many shares.

Every 10 shares held by an investor were replaced with one share. Though the split reduced the number of its shares outstanding from 29 billion to 2.9 billion shares, the market capitalization of the company stayed the same (at approximately $131 billion). An increase in the number of shares of a corporation’s stock without a change in the shareholders’ equity. Companies often split shares of their stock to make them more affordable to investors.

Why Does the ETN I Own Have So Many Reverse Splits?

There are various ways in which companies can manipulate their share price. One of these ways is implementing a corporate action called a stock split. The following guide, illustrated by examples, will look at how a stock split works, how it is applied, and how it can affect an investor’s portfolio. Another reason, and arguably a more logical one, is to increase a stock’s liquidity. Stocks that trade above hundreds of dollars per share can result in large bid/ask spreads. A perfect example is Warren Buffett’s Berkshire Hathaway (BRK.A), which has never had a stock split.

They announce the ratio of the split, the shareholders of record date and the effective date or distribution date if announced as a dividend. Keep in mind that stock splits are commonly distributed as dividends, but unlike cash dividends, they are usually nontaxable. The ratio determines the number of pieces into which they will split a share of stock. Why do companies go through the hassle and expense of a stock split?

Removal from a national-level exchange relegates the company’s shares to penny stock status, forcing them to list on the pink sheets. Once placed in these alternative marketplaces for low-value stocks, the shares become harder to buy and sell. Investors should commonly avoid companies that have undergone a reverse stock split, unless the company provides solid plans to improve its performance. Because a stock split doesn’t change the underlying value of your investment, you may not notice any more substantial changes than the number of shares in your investment account. A 2 for 1 stock split doubles the number of shares you own instantly.